A class action complaint has been filed against Yuga Labs Inc., the cryptocurrency business that created the Bored Ape Yacht Club NFTs, and it has identified dozens of famous people.

The lawsuit, which was filed on Thursday in a federal court in Los Angeles, claims that A-list performers, athletes, and artists received covert payments to “misleadingly promote” and exaggerate the worth of Yuga Financial Products. Plaintiffs Adam Titcher and Adonis Real claim that a “vast scheme” led to “staggering losses” for investors after they allegedly started buying Yuga assets in 2021.

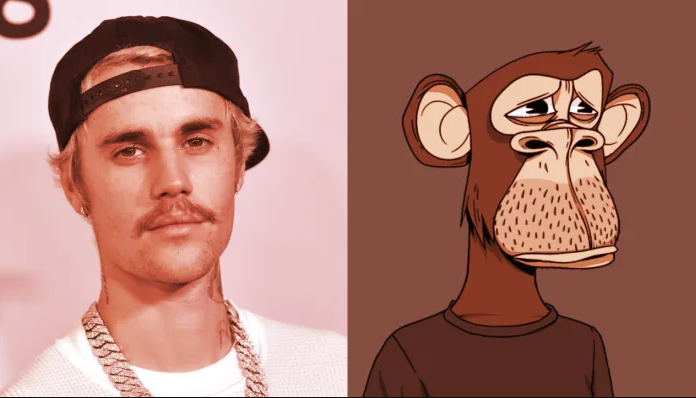

The complaint, which Rolling Stone was able to get, claims that Yuga collaborated with entertainment manager Guy Oseary on a strategy to “leverage their vast network” of famous clients. According to the lawsuit, celebrities like Justin Bieber, Post Malone, Snoop Dogg, the Weeknd, Kevin Hart, and others used MoonPay, a financial technology business with connections to Oseary’s Sound Ventures investment firm, to promote Bored Ape and other Yuga products.

“Defendants’ promotional campaign was wildly successful, generating billions of dollars in sales and re-sales,” the lawsuit reads, “The manufactured celebrity endorsements and misleading promotions regarding the launch of an entire BAYC ecosystem (the so-called Otherside metaverse) were able to artificially increase the interest in and price of the BAYC NFTs during the Relevant Period, causing investors to purchase these losing investments at drastically inflated prices.”

Reddit co-founder Alexis Ohanian, NFT artist Beeple, Oseary, officials from Yuga Labs and MoonPay, as well as famous people like Paris Hilton, Diplo, Future, Jimmy Fallon, Gwyneth Paltrow, DJ Khaled, and Madonna are also named as defendants in the complaint. According to the plaintiffs, false celebrity endorsements produced billions of dollars, and “at no point did any of the defendants register these securities with the SEC.”