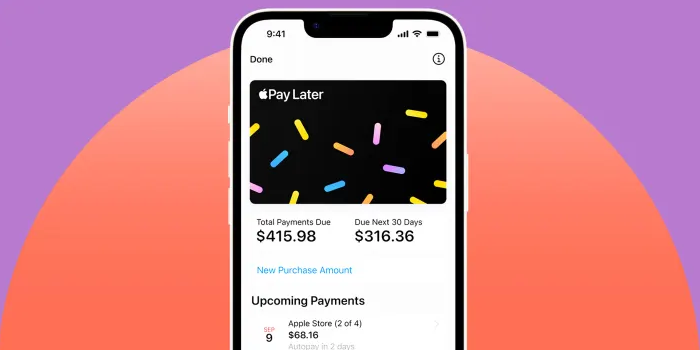

TODAY Illustration / Apple

Apple announced the launch of Apple Pay Later on Tuesday, allowing customers to split purchases into four payments.

The new function gives consumers the option to split payments that total $50 to $1,000 into four over the period of six weeks, as explained in a post on Apple’s Newsroom. On both the iPhone and iPad, it may be used for online or in-app transactions with merchants that accept Apple Pay. It will first be offered to a limited number of customers before being made available to all eligible users in the future.

“There’s no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we’re excited to provide our users with Apple Pay Later,” said Apple’s vice president of Apple Pay and Apple Wallet, Jennifer Bailey. “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Users can apply for the loans through the Apple Wallet app, and there are no interest or other costs associated with purchases with this option. Individuals who qualify for the service will be able to view a list of their current loans, along with information on the balance due in the following 30 days.

Users must attach a debit card to their account in order to repay the loans, which will be deducted automatically over the course of three payments after the original purchase. Credit cards are not accepted.